- Company

-

Strategies

- Smart beta

- Pure Alpha

- P2P Credit Portfolio

- Real Estate

- Investment Funds

- Project Investments

-

Services

- 1. What is the Smart Beta strategy?

- 2. How does it work?

- 3. What is the value of this strategy for investors?

- 4. What is the efficiency evidence of the strategy?

- 5. What is offered to investors?

- 6. What is our advantage over other providers of similar services?

- 7. How to become an investor in this strategy?

-

What is the Smart Beta strategy?

Smart Beta is an investment strategy in the global stock market based on a risk factor approach. The idea of this approach is that the properties of an asset can be broken down into subcomponents - risk factors. Their sum provides the final characteristics of an asset.

Read moreFor example, the risk-yield of corporate bonds can be divided into several risk factors: interest rates and the issuer's credit risk. Interest rates, in turn, can also be divided into duration and inflation, which are the basic risk factors for government bonds without credit risk. Risk factors can be divided into three broad categories within their inherent risks and returns (risk premium):- 1. Traditional. For example, market equity beta premium (stock index returns, depending on many macro-indicators). Positive risk premium exists in the long run and in the equilibrium state of the market. These factors do not contradict modern portfolio theory or the theory of market efficiency.

- 2. Alternative Beta (Smart Beta). Based on various forms of market inefficiency: due to irrational behavior of investors, restrictions on the investment policy of institutional investors and other barriers. The risk premium can be both positive and negative. It has a cyclical nature.

- 3. Idiosyncratic. These factors contain unique asset characteristics.

-

How does it work?

The strategy uses the following set of factors united by a common theme: Sentiment, Value, Quality, Momentum, Volatility, Size. For each set of factors, there are quantitative descriptors, for example, for the Sentiment theme, a number of parameters are used, such as: EPS Estimates (analysts' estimates of company profitability and change of this indicator over time), Estimates Deviation (standard deviation of these estimates), Surprise (actual indicators exceed predictive) and so on.

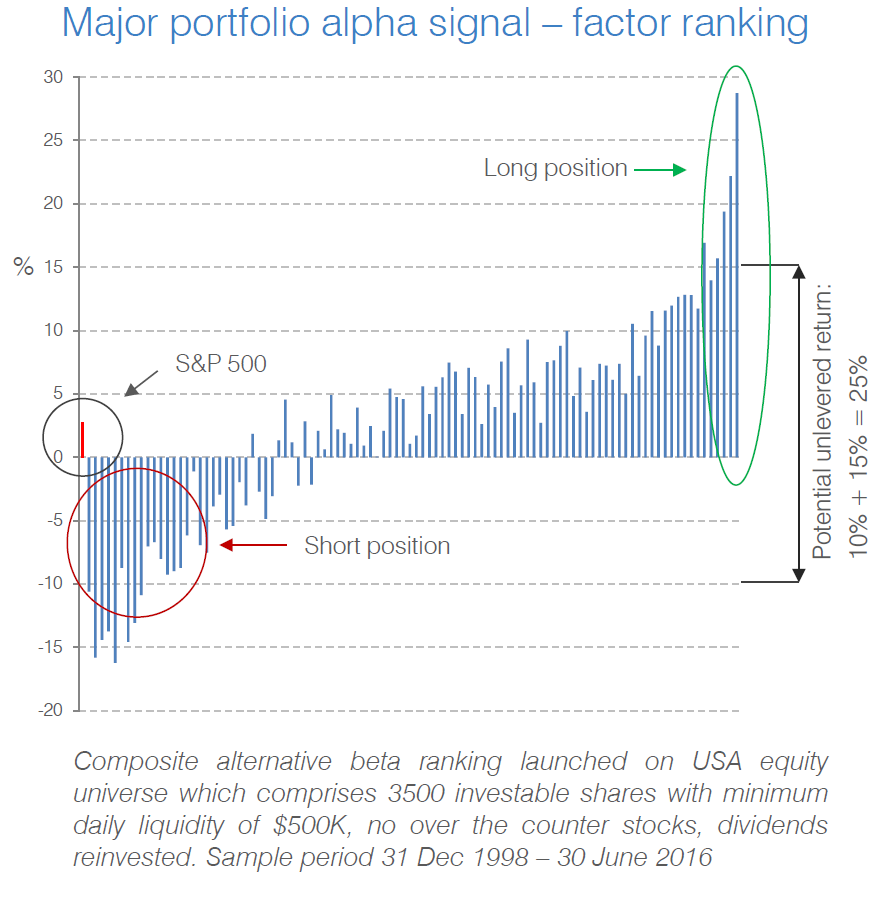

Read moreEach block has from 5 to 30 different parameters. Each company from the S&P Capital IQ financial information database is ranked according to these indicators (factor ranking). The top 5% of shares is bought, 5% with the lowest scores sold in short.

-

What is the value of this strategy for investors?

The value of the strategy lies in the fact that these factors in the long run beat market indices in terms of risk-return, and also have a low correlation to market indices and to each other. Thus, the combination of these factors in a single model provides an additional increase in the efficiency of investments.

Read more/a> -

What is the efficiency evidence of the strategy?

Back testing of the strategy has been produced since the beginning of 1999. When targeting a 10% risk level (10% annual volatility), we get an average return of more than 15% in USD. Detailed results are shown below.

Read more -

What is offered to investors?

Standart Smart Beta PortfolioDescription:- Smart Beta is a strategy of investing in the global stock market based on the risk factor approach

Currency:- USD

Exposure to risk factors:- Traditional equity beta + smart beta + interest rate risk

Asset classes:- Shares in the global stock market

- US government bonds

Target rate of return:- 15%+ (excluding asset management fees)

Target risk level:- 10% portfolio volatility (maximum drawdown ~15%)

Leverage:- Up to 2x

Use of short sales:- Yes

Number of assets in the portfolio:- From 50 to 200 individual tickers including ETF

Minimum capital ticket:- From $100k

Liquidity:- Depends on the capital amount. Positions up to $1M can be closed within 3 business days.

Management Fee:- Management fee 1.5% per annum

- Success fee: 25% of profit above 5% p.a. of the investor

Investment Term:- From 1 year (Early complete liquidation of all positions within a few days and withdrawal of funds from the account is possible. The remainder of the annual commission will be withheld in this case).

Strategy benefits:- High yield with moderate risk

- Moderate correlation to global stock indices

- The system is a long-term investment strategy in contrast to short-term speculative trading. Rebalancing of the portfolio occurs once a week.

- The strategy is not offered for retail investors.

-

What is our advantage over other providers of similar services?

Currently management companies and investment product suppliers do not offer active Smart Beta strategies for retail customers. Others have a high entry ticket ($1M) and high transaction costs for attracting and servicing clients. This results in high commissions regardless of the investment outcome.

Read moreIt is impossible to create a portfolio for an individual client profile with small amounts of capital. Moreover, there are problems in finding and choosing the right management company, passing KYC procedures clients, structuring investments in order to minimize taxation. And our most important advantage is the high efficiency of the proposed systems. Dealing with large amounts of capital is affected by difficulty in obtaining alpha (risk adjusted return relative to market return). Large investment companies are not able to take full advantage of the Smart Beta strategies. -

How to become an investor in this strategy?

Action plan for a potential investor is the following:

- You should contact us by phone, email or meet at the office.

- Based on the discussion results, we draw up an investment profile of a potential client and make a report with recommendations on the composition of strategies for the investment portfolio.

Read more- This is followed by opening a client’s account and making a deposit within Interactive Brokers (the largest international discount broker) - https://www.interactivebrokers.com

- You sign an investment portfolio management contract with us.

- You tie your account to our IB advisory account. The funds remain within your account under our management without possibility of unauthorized access or withdrawal of funds from our side. This ensures absolute safety of your funds, as well as full automatization of all the investment process.

- As a result, you see your account balance online from any device. Detailed reports with the results of investment and the calculation of management fees are provided by us quarterly.

Alphatek Advisors is an alternative investment platform

The proposed investment strategies, such as Smart Beta, Pure Alpha, P2P loan portfolio are based on years of research and development of our team, have a long track record and outstanding risk-return characteristics, and presented for the first time in the Russian market for retail clients. Our priority is to find and select the most promising and profitable strategies for creating an investment portfolio.