- Company

-

Strategies

- Smart beta

- Pure Alpha

- P2P Credit Portfolio

- Real Estate

- Investment Funds

- Project Investments

-

Services

- 1. What is Pure Alpha?

- 2. How does it work?

- 3. What is the value of this strategy for investors?

- 4. What is the evidence of the efficiency of the strategy?

- 5. What is offered to investors?

- 6. What is your advantage over other providers of similar services?

- 7. How to become an investor in this strategy?

-

What is Pure Alpha?

Pure Alpha is a global stock market investing strategy based on a risk factor approach similar to Smart Beta.

Read moreThe difference is in the way of processing factor values (static in Smart Beta and dynamic in Pure Alpha) as well as in excluding the first Beta component in the asset risk-return formula and focusing on the factors specific to the asset. In simple terms, these systems are market neutral and generate income in any state of the market. -

How does it work?

Using the fundamental data ranking of Smart Beta systems (see the corresponding section) the securities applicable for Pure Alpha algorithms are filtered. Further, the change in individual rankings is calculated for each security by special algorithms. The size and sign of the position of the respective asset is determined to capture the maximum future return considering the risk and reliability of the system.

Read moreMachine learning and neural networks algorithms used to create individual portfolios. Further, the least correlated algorithms are collected in a market-neutral investment portfolio and the final weighting of positions on securities is made. The holding period for each security ranges from several days to several months (as opposed to short-term algorithmic trading). Below is an example of how an algorithm works on an individual security. As can be seen from the graph, our algorithms significantly improve the risk/return of an individual asset, and most importantly, the market beta close to zero allows you to combine non-correlated signals according to individual security characteristics into a single portfolio of strategies.

-

What is the value of this strategy for investors?

Pure Alpha portfolios show performance of up to 2x Sharpe ratio (market index averages 0.7x Sharp). For the investor, this means 15-20% yield with 10% volatility, regardless of the conditions in the stock market.

Read more -

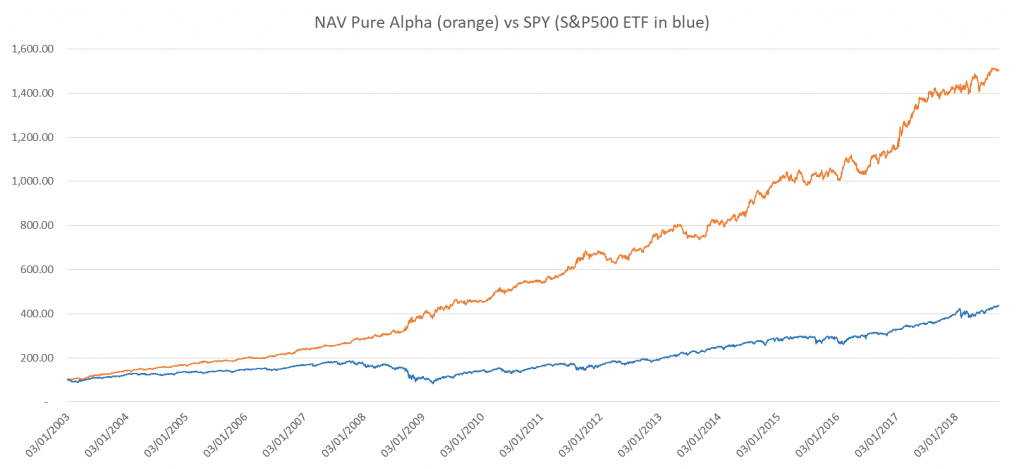

What is the evidence of the efficiency of the strategy?

Pure Alpha systems have passed the testing stages and started the track record on the accounts of individual clients. Data is provided after the NDA signing.

-

What is offered to investors?

Pure Alpha standard portfolioDescription:- Pure Alpha is a global stock market investing strategy based on a risk factor approach similar to Smart Beta. The difference is in the way of processing factor values (static in Smart Beta and dynamic in Pure Alpha) as well as in excluding the first Beta component in the asset risk-return formula and focusing on the factors specific to the asset. These systems are market neutral and generate income in any state of the stock market.

Currency:- USD

Exposure to risk factors:- Smart beta + interest rate risk + system alpha

Asset classes:- Shares in the global stock market

- US government bonds

Target rate of return:- 15%+ (excluding asset management fees)

Target risk level:- 10% portfolio volatility (maximum drawdown ~15%)

Leverage:- Up to 5x

Use of short sales:- Yes

Number of assets in the portfolio:- From 50 to 200 individual tickers including ETF

Minimum capital ticket:- From $250k

Liquidity:- Depends on the amount of capital (can be very high if necessary)

Aphatek commission:- Management fee 1.5% per annum

- Success fee: 25% of profit above 5% p.a. of the investor

Investment Term:- From 1 year (early complete liquidation of all positions within a few days and withdrawal of funds from the account is possible. The remainder of the annual commission will be withheld in this case).

Strategy benefits:- The system is a long-term investment strategy in contrast to short-term speculative trading. Rebalancing of the portfolio occurs once a week.

- It allows you to get 15-20% return in USD with very moderate risk (10% volatility whereas market volatility is 20%) regardless of the market conditions

- This strategy is not offered for retail investors.

-

What is your advantage over other providers of similar services?

In contrast to the traditional algorithmic trading, alpha signals are defined by more informative fundamental data of companies, not just by the stock price. In Big Data this allows you to achieve 2-3 times better investment results.

Read moreThe system is a long-term investment strategy in contrast to short-term speculative trading. Rebalancing of the portfolio occurs once a week.

It allows you to get 15-20% return in USD with very moderate risks (10% volatility whereas market volatility is 20%) regardless of the market conditions.

-

How to become an investor in this strategy?

Action plan for a potential investor is the following:

Read more- You should contact us by phone, email or meet at the office.

- Based on the discussion results, we draw up an investment profile of a potential client and make a report with recommendations on the composition of strategies for the investment portfolio.

- This is followed by opening a client’s account and making a deposit within Interactive Brokers (the largest international discount broker) - https://www.interactivebrokers.com

- You sign an investment portfolio management contract with us as well as an NDA of algorithms and strategies in use in case of individual portfolio composition

- You tie your account to our IB advisory account. The funds remain within your account under our management without possibility of unauthorized access or withdrawal of funds from our side. This ensures absolute safety of your funds, as well as full automatization of all the investment processes.

- As a result, you see your account balance online from any device. Detailed reports with the results of investment and the calculation of management fees are provided quarterly by us.

Alphatek Advisors is an alternative investment platform

The proposed investment strategies, such as Smart Beta, Pure Alpha, P2P loan portfolio are based on years of research and development of our team, have a long track record and outstanding risk-return characteristics, and presented for the first time in the Russian market for retail clients. Our priority is to find and select the most promising and profitable strategies for creating an investment portfolio.